Luxembourg: Financial Sector Assessment Program in: IMF Staff Country Reports Volume 2017 Issue 260 (2017)

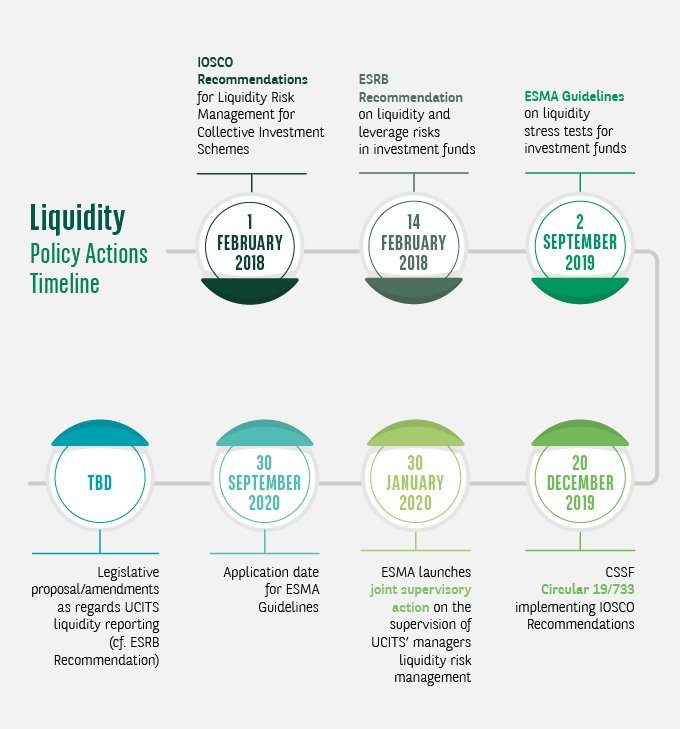

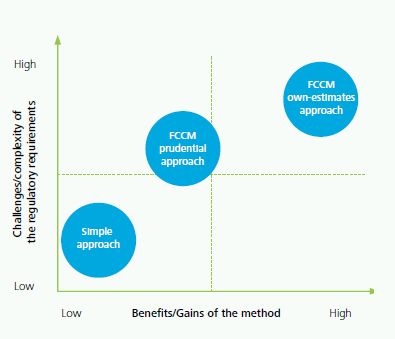

Liquidity Risk Management: new regulatory requirements for investment funds | Deloitte Luxembourg | Investment Management

Synermesh Consulting IT Regulatory and Compliance team review the CSSF demands on the supervision of information systems - Synermesh Consulting

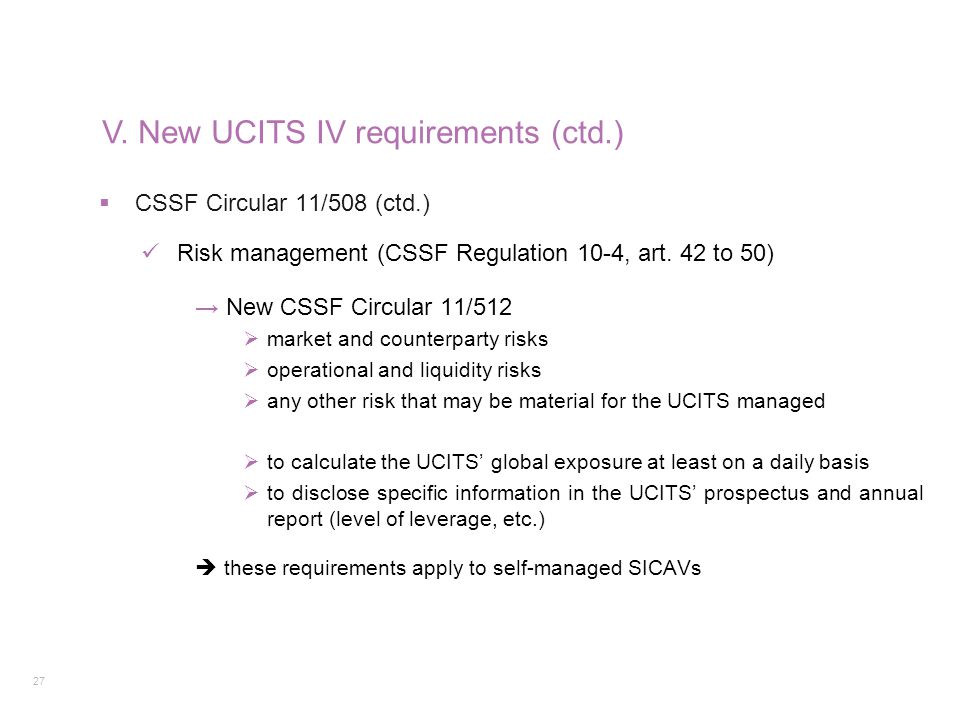

CSSF Circular 20/758 Relating to Central Administration, Internal Governance and Risk Management | Wildgen

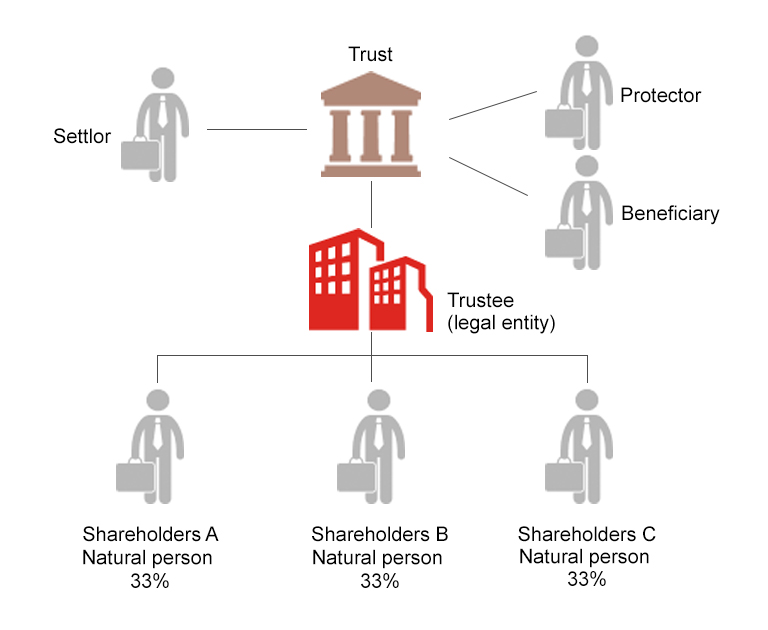

Luxembourg: Financial Sector Assessment Program: in: IMF Staff Country Reports Volume 2017 Issue 255 (2017)

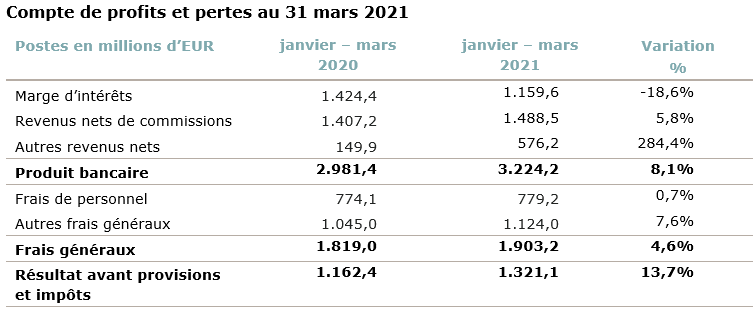

Profit and loss account of credit institutions as at 31 March 2021 (only in French) | Regulatory.News

CSSF implements IOSCO recommendation on liquidity risk management for investment funds | Deloitte Luxembourg | Investment Management | News

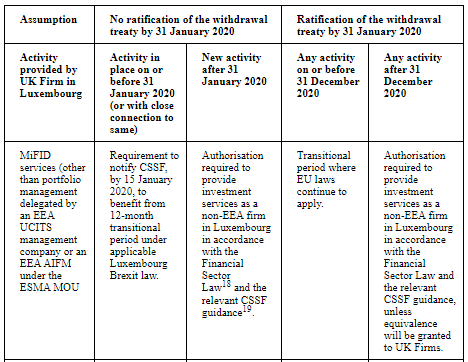

Luxembourg: 2019 Article IV Consultation—Press Release; Staff Report; and Statement by the Executive Director for Luxembourg in: IMF Staff Country Reports Volume 2019 Issue 130 (2019)

Circular CSSF 19/733 – Liquidity risk management of open-ended undertakings for collective investment (“UCIs”) | EY Luxembourg