JRFM | Free Full-Text | Long- and Short-Term Cryptocurrency Volatility Components: A GARCH-MIDAS Analysis | HTML

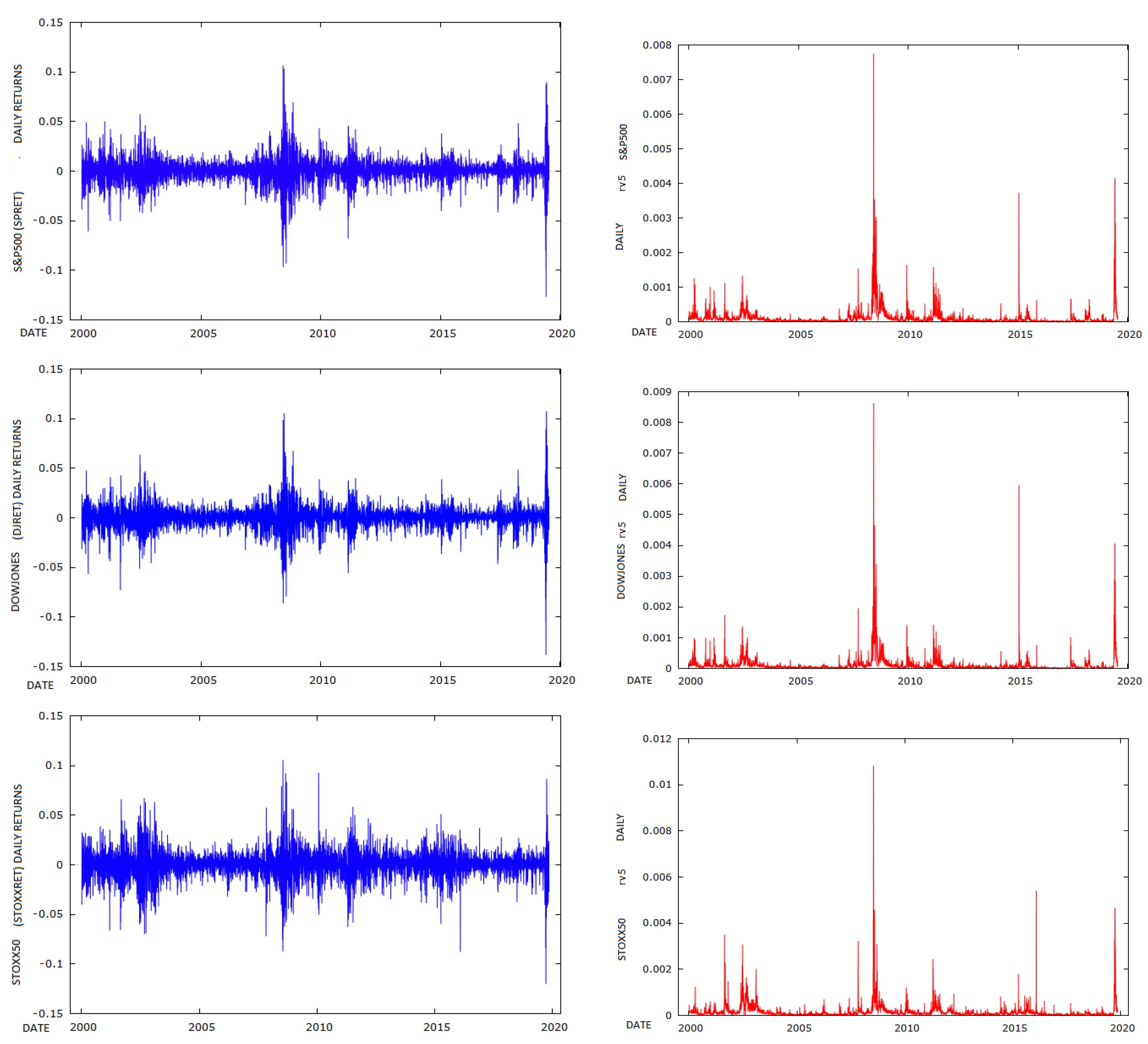

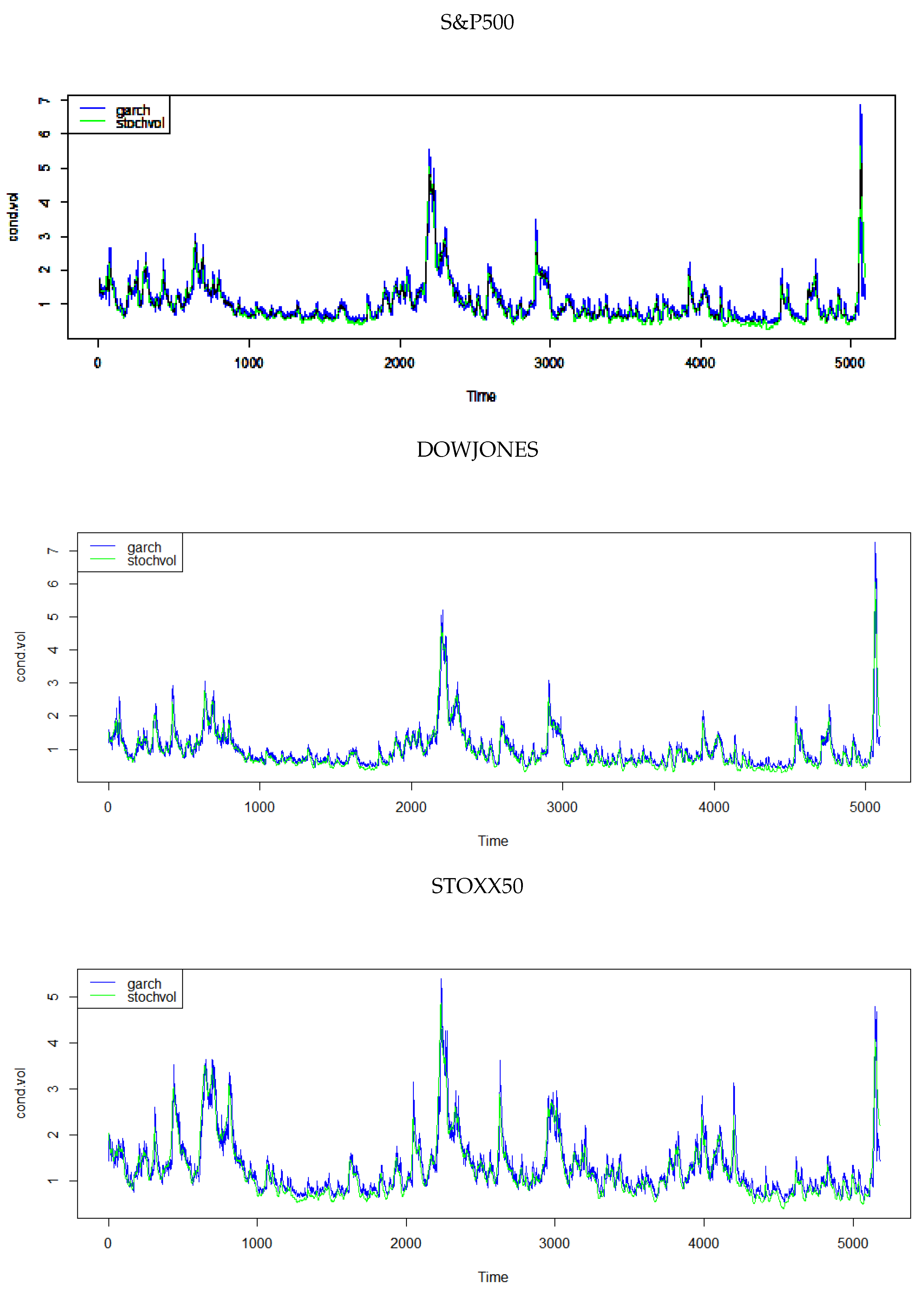

JRFM | Free Full-Text | Stochastic Volatility and GARCH: Do Squared End-of-Day Returns Provide Similar Information? | HTML

The Cross‐Section of Volatility and Expected Returns - ANG - 2006 - The Journal of Finance - Wiley Online Library

PDF) Hedging Equity Index Portfolios with Implied Volatility – Empirical Evidence from European Stock and Implied Volatility Futures Market 2010-2016

PDF) Hedging Equity Index Portfolios with Implied Volatility – Empirical Evidence from European Stock and Implied Volatility Futures Market 2010-2016

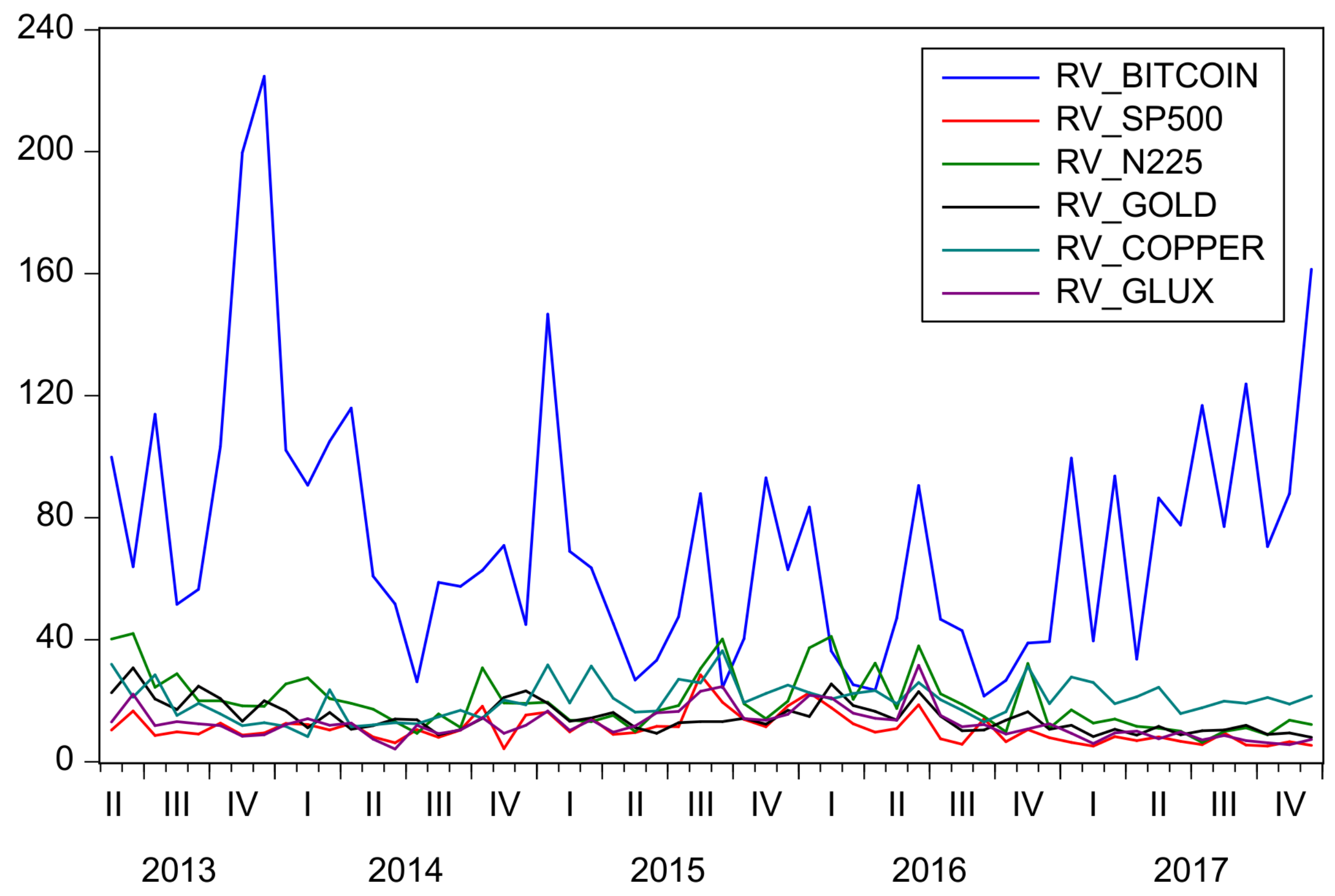

JRFM | Free Full-Text | Long- and Short-Term Cryptocurrency Volatility Components: A GARCH-MIDAS Analysis | HTML

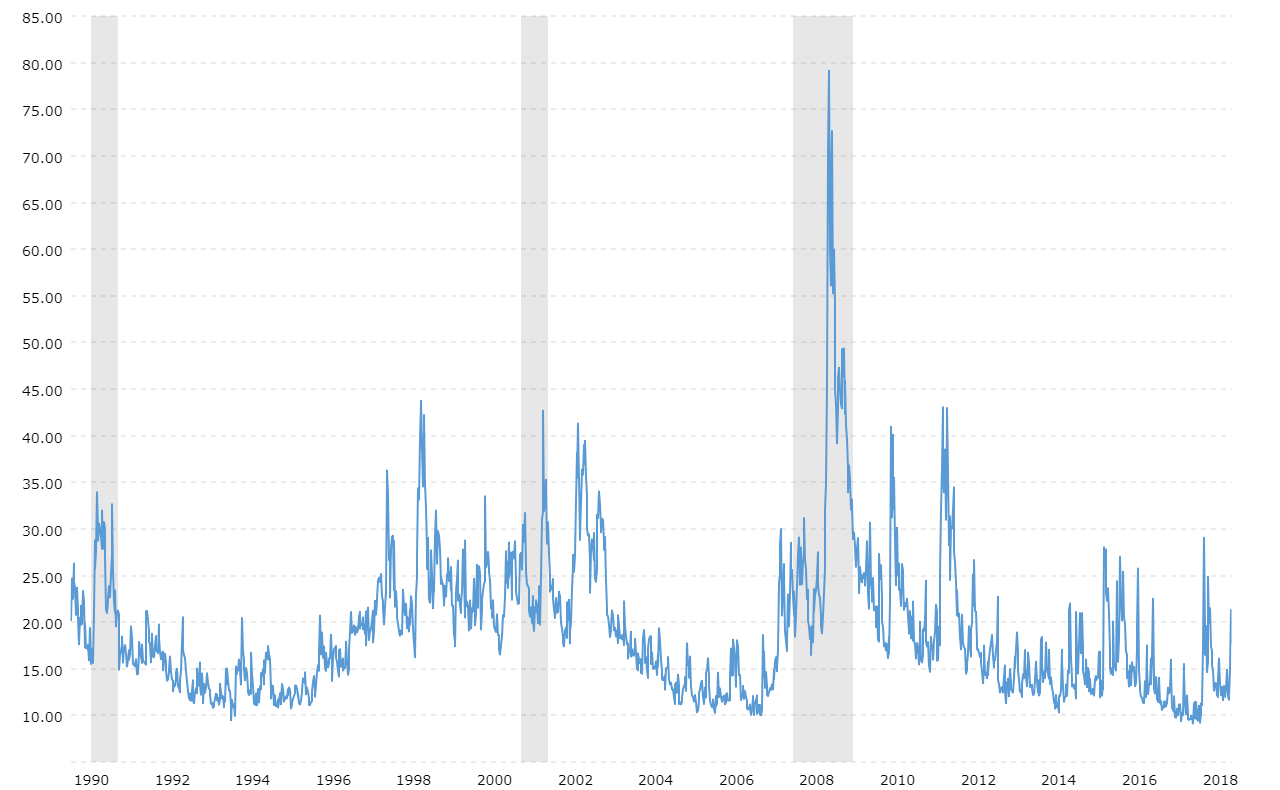

Why Does Stock Market Volatility Change Over Time? - SCHWERT - 1989 - The Journal of Finance - Wiley Online Library

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

/dotdash_INV-final-Williams-R-Definition-and-Uses-June-2021-01-b5f61d727df74545967310850ad46802.jpg)